Member services

Get what you need, the way you need it at our Rochester credit union. Explore the personal and business services below to learn how you can access our mobile banking app, bill pay, direct deposit, and wire transfer options in person and online.

Digital Banking

Genesee Co-op's upgraded home and mobile banking platforms offer you easy access to your accounts from anywhere, anytime. You can check your balance, transfer money between accounts, apply for a loan, sign up for statements, or change your address.

- Deposit checks using the mobile app without coming to the credit union. Some limits apply.

- Freeze your debit card if you are worried about fraud

- Apply for a loan

- Add a new sub-savings account

- Update your address or personal information

Online Bill Pay

Genesee Co-op gives you many options to pay your bills, safely, securely and on-time. Bill pay using the mobile app allows you to send payments to most corporate billers electronically, and also to send checks to anyone you want!

- Pay bills for utilities, insurance, and more, electronically write from our mobile app

- Send checks to anyone in the United States - without having your own checkbook or sharing your account number

- Bill pay is available in both the mobile app and in online banking

- You can even share billers and history with the joint owners of your account - just contact us to turn this on

Debit Card & ATM Access

Genesee Co-op's Visa® debit cards can be used at almost any retailer that takes credit or debit cards, you can take money out at almost any ATM globally. Our cards are tap-to-pay compatible and we also offer Apple Pay, Google Pay, and Samsung Pay so you can add your card to your phone - no need to carry it with you.

ATM Access

The ATM at the credit union is always free for members with their Genesee Co-op debit card. Members can also access over 30,000 surchage-free ATMs nationwide. Genesee Co-op will only charge you $1 after using non-Genesee-Co-op ATMs four (4) times per month.

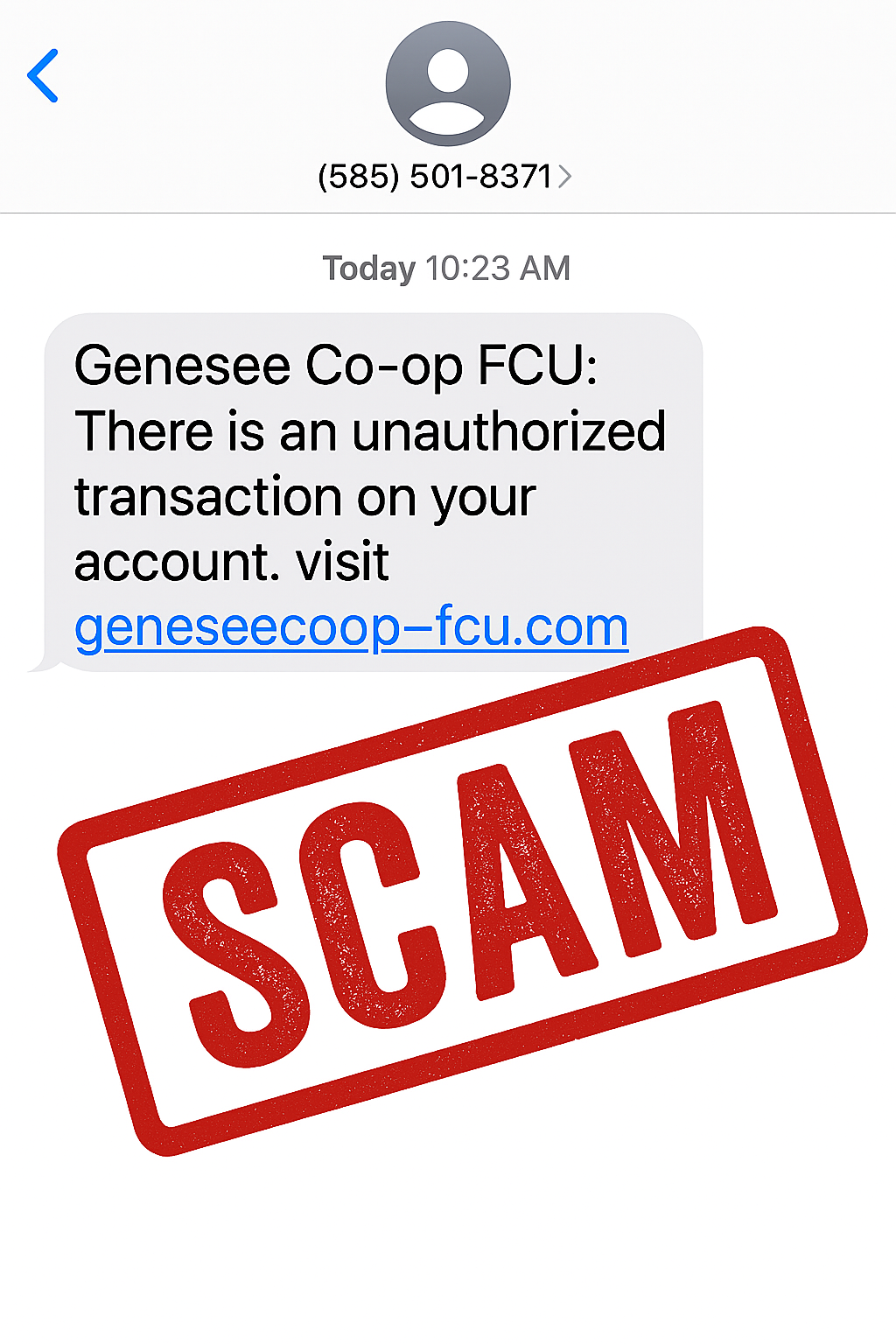

Fraud Prevention

Genesee Co-op's debit card network monitors your card transactions for fraud and attempts to block any transactions that are likely fraudulent. If you give us your cell phone number and email, the system can automatically send you a fraud notification helping you to protect your account. Your protected from fraud on your debit card over $50 as long as you notify us within 60 days of the mailing of the statement period during which the fraud occurred.

You can help prevent fraud on your account by:

- Monitoring your account regularly using Digital Banking

- Turning off your card if there are any suspicious transactions. You can turn off your card using our Digital Banking tools, by calling the credit union and speaking to someone during open hours, OR by calling the credit union and choosing "9" while we are closed

Shared Branching

You can access your Genesee Co-op account at over 5,000 shared branches nationwide including over 100 in Puerto Rico. Just bring your ID, account number, and the name of Genesee Co-op and they can look you up. At most shared branches you can make deposits, withdrawals, and purchase cashiers checks. Please note Shared Branching is subject to daily limits by both Genesee Co-op and the credit union you are visiting. Some shared branches even offer Saturday hours.

Other Services

We offer a variety of other services to help you manage and access your money.

We can help you send and receive money nationwide and around the world. It is free to receive domestic wires. Domestic and international wires can be sent for a reasonable fee. For fees, you can take a look at our fee schedule.

At our 395 Gregory Street branch you can get the change you need for your business or special event. You can also deposit currency. If you need substantial amounts of a single denomination or more than $3,000 we typically require 24 hours notice; call to let us know. Please roll more than nominal amounts of coin - we can even provide you the coin wrappers.

You can deposit cash or checks in our deposit drop box located right outside the credit union door whether we are open or closed. Please put deposits with a deposit slip or instructions inside a sealed envelope and make sure the envelope is pushed in all the way. Deposits are entered each morning and again 30 minutes befor we close each day.

You can receive your paycheck or send money to Genesee Co-op directly using your routing and account number. We can provide you a direct deposit slip with instructions to provide to your employer if necessary. You can also provide your routing and account number to any company like a phone or utility company to take money out of your account automatically.

Have questions?

Bank with us

At Genesee, you’re not a number. You’re a member-owner. That means the benefits from our Rochester credit union go to you. Not shareholders thousands of miles away.

News & Updates

.png)